Why home values may take decades to recover

By Dennis Cauchon, USA TODAY - 12/12/08

Rick Wallick moved into a new, three-bedroom $200,000 home in Maricopa, Ariz., in October 2005. Today, the home is worth $80,000.

The disabled software engineer stopped making mortgage payments this month. His $70,000 down payment is now worthless. His dream house will be foreclosed on next year.

"We're so far underwater it's not funny," says Wallick, 57, who had to return to his original home in Oregon to care for a sick family member and tend to his own medical problems. Wallick, one of the hardest-hit victims in one of the states hit hardest by the housing crisis, lost 60% of his home's value in three years.

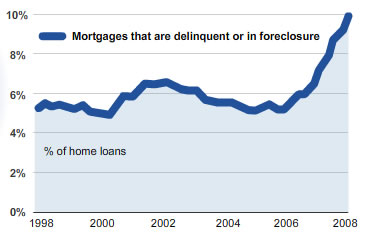

His story is an extreme example, but home values have fallen so sharply since hitting a historic peak in the spring of 2006 that many Americans are wondering how much more prices can sink.

As painful as the decline has been, history suggests home values still may have a long way to drop and may take decades to return to the heights of 2½ years ago.

"We will never see these prices again in our lifetime, when you adjust for inflation," says Peter Schiff, president of investment firm Euro Pacific Capital of Darien, Conn. "These were lifetime peaks."

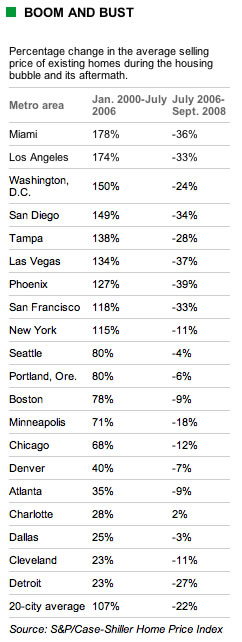

The boom in home prices — fueled by heavily leveraged loans built on low or even no down payments — made it easy to forget that housing values had been remarkably stable for a half-century after World War II, rising at roughly the same pace as income and inflation. Prices soared in most of the country — especially in Arizona, California, Florida and Nevada and metro areas of Washington, D.C., and New York — during a brief period of easy lending, especially from 2002 to 2006. That era's over.

So far, home values nationally have tumbled an average of 19% from their peak. As bad as that is, prices would need to fall as least 17% more to reach their traditional relationship to household income, according to a USA TODAY analysis of home prices since 1950. In that scenario, a $300,000 house in 2006 could be worth about $200,000 when real estate prices hit bottom.

The price plunge has wiped out trillions of dollars in home equity and caused the worst financial crisis since the Great Depression. Susan Wachter, professor of real estate at the University of Pennsylvania, fears that foreclosures and tight credit could send home prices falling to the point that millions of families and thousands of banks are thrust into insolvency.

"Homes are different than other goods and services," she says. "The fragility of our banking system is tied to the value of homes."

Home values have fallen before — during the Great Depression and in Texas after a 1980s oil boom, for example — but those drops were a response to other economic forces. This time, the housing price collapse is the cause of the nation's broad economic troubles, not just an effect.

"If we have another 20% decline in prices, we'll need another bailout of banks similar to what we just did," Wachter says.

Other economists see a brighter picture in the long term. Wachovia economist Adam York expects home values to keep falling until 2010 but is optimistic they will recover.

"The one saving grace is the population is growing by 3 million people a year," he says. "They need to live somewhere. That means more roofs."

50 years of steady values

Until recently, homes were stable, unspectacular investments, not get-rich-quick schemes.

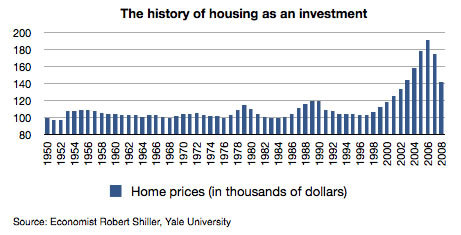

Nationally, the typical existing home was worth roughly the same in 2000 as it was in 1950, after adjusting for inflation, according to Yale University economist Robert Shiller.

Newly built homes generally were bigger and more expensive than older houses. As time passed, that meant Americans lived in larger, more valuable homes overall. But a house, once constructed, grew slowly in value. California in the 1970s, Texas in the 1980s and Florida on-and-off for a century were conspicuous exceptions to the rule.

Despite only modest increases in value, homes were smart investments. Owners lived in a house, then got their money back when they sold. That's a better deal than renting. Borrowers got tax breaks, too, and built equity that could be leveraged into bigger houses as their incomes grew.

From 2002 to 2006, houses went from being a tortoise to a hare in the investment world. Home sale profits and relaxed lending standards such as lower down payment requirements and adjustable-rate mortgages (ARMs) made it possible for buyers of all income levels to pay more for houses.

When the housing bubble began to deflate in 2006, history had a sobering lesson to teach. Home values had closely tracked three common-sense measures for many years:

• Income —Home values floated at about three times average household income from 1950 to 2000. In 2006, the average household income was $66,500. Under the traditional model, home prices should have been about $200,000. Instead, the typical home sold for $301,000.

•Rent —Homes traditionally have sold for about 20 times what it would cost to rent them for a year. In 2006, houses were selling for 32 times annual rent.

•Appreciation —Existing homes grew in value by less than 0.5% per year, after adjusting for inflation, from 1950 to 2000. From 2000 to 2006, home prices rose at an average annualized rate of 8.2% above inflation and peaked with a 12.3% jump in 2005. Housing prices began to fall in the second quarter of 2006.

Inflation could help homes recapture their old prices, if not their value. But when inflation is factored in, home prices might not return to their 2006 peak for many years. Housing prices are meaningless if you don't adjust for inflation, says Schiff, the investment manager.

He points out that gold peaked in 1980 at $850 an ounce in response to inflation and the Iranian hostage crisis. It never recovered. Today, it sells for about $750 an ounce and would have to top $2,000 an ounce when adjusted for inflation to match its value in 1980.

"That's the nature of bubbles," Schiff says. "The price never comes back."

The end of inflated leverage

An extreme relaxation of lending standards inflated the housing bubble.

"Shoddy underwriting on mortgages" is the primary cause of the housing crisis, says York, the Wachovia economist. "People got caught off-guard by how bad it was."

Millions of home buyers — poor, rich and middle class — were approved to buy homes at prices that had been out-of-reach just a few years earlier. Lenders offered low introductory "teaser" rates on adjustable rate mortgages and approved borrowers based on artificially low mortgage payments, not the higher ones that took effect later.

What else changed:

• Optional payments on principal —In 2005, 29% of new mortgages allowed borrowers to pay interest only — not principal — or pay less than the interest due and add the cost to the principal. That was up from 1% in 2001, according to Credit Suisse, an investment bank.

• No verification of income —Half of mortgages generated in 2006 required no or minimal documentation of household income, reports Credit Suisse.

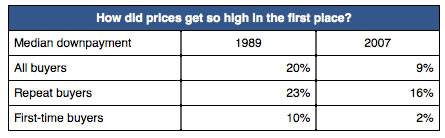

• Tiny down payments —In 1989, the average down payment for first-time home buyers was 10%, reports the National Association of Realtors. In 2007, it was 2%.

Low down payments and ARMs gave homeowners enormous financial leverage to pay high home prices. Leverage boosts buying power through debt, the same way a 100-pound woman uses a lever to jack up a 3,000-pound car.

Consider a couple with $20,000 cash. In 2006, they easily could get a 5% down mortgage to buy a $400,000 house. Today, a 10% down payment would limit the couple to a $200,000 house.

"Leverage matters a lot when you buy a house," says University of Wisconsin economist Morris Davis, an expert on housing prices and rents. "We're not going to go back to the days of only 20% (down payment) mortgages, but the days of putting nothing down are long gone."

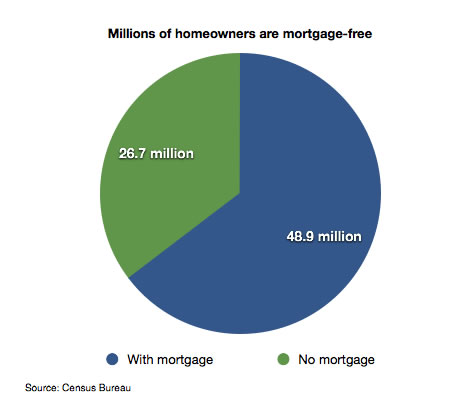

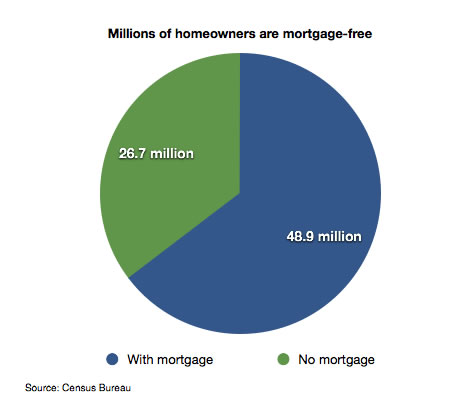

Easy access to borrowed money reset all housing prices, even those paid by cautious borrowers. People of all income classes moved up a notch, Census Bureau housing data show.

The sale of new homes costing $750,000 or more quadrupled from 2002 to 2006. The construction of inexpensive homes costing $125,000 or less fell by two-thirds. The biggest boom was in the middle. Homes costing $200,000 to $300,000 became affordable to millions of families.

The failed titans of home lending — Countrywide Financial, IndyMac Bank and Washington Mutual — specialized in high-risk, highly leveraged loans.

"The price correction has been severe, rapid and probably permanent because lending standards have changed," says mortgage credit analyst Suzanne Mistretta, a senior director at Fitch Ratings, a bond rating company. "We are not going to see 2006 peak levels for a very, very long time."

Lessons from the Depression

The Great Depression of the 1930s was preceded by a real estate bubble, also fueled by loose lending standards and shrinking down payment requirements. Those real estate problems — and solutions — echo today's.

Florida real estate was the epicenter of speculation in the mid-1920s. Developers ran up prices by selling to borrowers who put as little as 10% down. Those were shockingly risky loans at a time when the standard mortgage lasted five years and required a 50% down payment.

The risky loans went bad first, but it was the spread of credit problems to the supposedly safe loans — five years and 50% down — that caused the housing market to collapse.

The five-year loans required no payments to reduce principal. Homeowners expected to refinance mortgages when the loans expired, usually with the same lender. The stock market crash led to a "liquidity crisis" — no money to borrow — that dried up mortgage refinancing.

Millions of families lost their homes to foreclosure. Falling prices on nearly everything — homes, farm crops, wages — made consumers reluctant to buy and banks afraid to lend.

As part of the New Deal, the government took control of millions of loans and restructured them into something new: the modern mortgage, with 20% down and principal that is repaid over the life of the loan. The government extended the mortgages to 15 years, then 25 and finally 30.

When World War II ended in 1945 and the Baby Boom began the following year, the 30-year, fixed-rate mortgage became a cornerstone of society and led to unprecedented levels of homeownership.

This resilient home finance system should recover in a few years, some analysts say.

National Association of Realtors chief economist Lawrence Yun predicts home prices will keep falling in 2009 but could return to their 2006 peak in three years, not counting inflation.

He says the bubble largely was confined to four states — California, Nevada, Florida and Arizona. "People who bought at the peak in those states will need time for prices to recover, even up to five years," he says. Yun says people who buy now "have much less risk of price declines and a great possibility of price gains."

The danger of rapidly falling home prices is that — similar to the Depression — potential buyers and lenders will stay away, fueling even sharper price declines.

During the housing boom, buyers expected prices to rise, so they were quick to buy, borrow and pay a premium. As prices drop, home buyers wait for better deals. says economist Dean Baker of the liberal Center for Economic Policy Research in Washington, D.C.

Lenders want bigger down payments to protect against the falling value of collateral. Homeowners lose equity, so they can't buy other houses. "Price declines can be a self-reinforcing mechanism," Wachter says.

An out-of-control price collapse would have dire consequences, Baker says. Even the most conservative banks would find themselves carrying portfolios of toxic mortgage loans.

If housing prices don't stabilize at traditional levels, financial troubles could spread everywhere — to credit cards, car loans and commercial mortgages, Baker says. "The waves of bad debt will just keep coming," he says.

Baker and Wachter want the U.S. government to take aggressive steps to help homeowners, not just financial institutions. They support expanding programs that restructure troubled mortgages to prevent a flood of foreclosed homes from coming on the market and driving prices below their traditional level.

Rick Wallick is an example of how even cautious borrowers can be hurt by a price collapse. He made a 35% down payment on his house and got a 15-year, fixed-rate mortgage at 5.75%.

Arizona's real estate mess wiped him out anyway. Now that he's in Oregon, he's renting out his Arizona house at a loss and can't afford to keep two homes.

Wallick's Arizona house is surrounded by countless foreclosed homes and empty lots. He told his mortgage company that his December payment will be his last. "It may ruin my credit rating, but I can still buy food," he says.

Shelley McComb used a no-money-down, interest-only ARM to pay $199,000 in December 2006 for a new three-bedroom home near Birmingham, Ala. The house's assessed value briefly rose to $225,000.

Now, she needs to move to Atlanta where her husband got a promotion. The McCombs put their home up for sale in March. After getting no offers, they dropped their price to $179,000. They'd settle for $160,000.

Shelley McComb, 30, who manages a doggie day care center, says, "I wish we'd rented."