Multiple Choice

Identify the letter of the choice that best

completes the statement or answers the question.

|

|

|

1.

|

A farmer obtains 5 ton hay yields and 15 ton corn silage yields. His cash costs

of production are $25 per ton of corn silage. One pound of hay will substitute for 2 lbs of corn

silage and not affect rate of gain. What proportion of hay and silage should this farmer use in his

cattle ration?

a. | Grow two acres of corn silage for each acre of hay | b. | Grow three acres of

hay for each acre of corn silage | c. | Grow only corn silage | d. | Grow only

hay |

|

|

|

2.

|

A rancher has $30,000 of operating capital. She can buy 35 steers or 300 feeder

pigs to finish for market. Total production costs per head are estimated to be $45 for pigs and $175

for steers. She can sell the market hogs for $90 per head and the steers for $300 per head. Given an

opportunity cost capital as 10%. She should:

a. | Finish the hogs | b. | Fatten the steers | c. | Put the money

elsewhere at 10% interest | d. | Put the money in her checking

account |

|

|

|

3.

|

If a feeder cattle producer had 100 head of 550 pound steers and could tell them

for $50 per cwt or send them to a custom feedlot which guaranteed the feeder 50 cents per pound of

gain. What price per cwt would the producer have to receive if he sent them to the feedlot in order

to break even with the offer he had at $50 per cwt when they weighed 550 lbs? Assume he planned to

feed them to a weight of 1000 pounds. Disregard the opportunity cost of capital, death loss and

shrinkage.

a. | $50 per cwt | b. | $53 per cwt | c. | $56 per cwt | d. | $62 per

cwt |

|

|

|

4.

|

A soybean producer is considering storing harvested soybeans in the local

elevator for 6 months to obtain a high price. The price at harvest is $4.50 per bushel and the

elevator charges $0.03 per bushel per month for storage. The farmer has 5000 bushels to sell and the

appropriate interest rate is 12% per year while the soybeans are held in storage. How much must the

price of soybeans increase over the six months in order for the farmer to cover storage and interest

costs?

a. | $0.18 per bushel | c. | $0.45 per bushel | b. | $0.21 per bushel | d. | $0.50 per

bushel |

|

|

|

5.

|

A lease between a landlord and a tenant is equitable if it:

a. | Divides returns equally between the landlord and the tenant | b. | Is written by an

attorney | c. | Holds strictly to traditional lease rates in the community | d. | Divides income

between landlord and tenant by contribution made by each |

|

|

|

6.

|

Mr. Reed needs to purchase a new tractor with a purchase price of $28,000. His

dealer will finance the tractor under the following terms. 10% down payment with the balance repaid

in equal payments over the next three years. The interest rate is 10% per year. Mr. Reed expects the

tractor to last for nine years and have a salvage value of $1000. How much interest will Mr. Reed pay

in the first year of the loan?$

a. | $1400 | b. | $5040 | c. | $2520 | d. | $2800 |

|

|

|

7.

|

You operate a farmed owned by Big John who contributes land worth $185,000 and

part of the operating expenses at $12,000. If you contribute your machinery at $50,000 and labor

worth $15,000 as well as $47,000 for operating expenses, what would your share of the $250,000 gross

income be if you share income according to your contribution?

a. | $112,000 | b. | $135,000 | c. | $90,000 | d. | $250,000 |

|

|

|

8.

|

You have borrowed $40,000 at a simple annual interest rate of 12% per annum for

4 years. Principal is to be repaid in four equal installments at the end of each year, with annual

interest payable with the principal payment. The payment due at the end of the first year would

be:

a. | $10800.00 | b. | $14,800.00 | c. | $16,500.00 | d. | $44,000.00 |

|

|

|

9.

|

A grain sorghum producer is trying to decide the total cost of storing harvested

grain in the local elevator for another three months. The elevator charges 4.0 cents per hundred

weight per month for storage. Assume the opportunity cost of holding the grain in storage is 10% per

year of the grains value ($3.00/cwt). What is the total cost per cwt of keeping the grain in storage

for three months?

a. | 24.0 cents per cwt | c. | 12.0 cents per

cwt | b. | 19.5 cents per cwt | d. | 7.5 cents per cwt |

|

|

|

10.

|

You sell 4 calves within average weight of 489 lbs for $92.25/cwt. You have 3%

sales commission and $1.50 per head yardage charge. Your net amount received would be:

a. | $450.30 | b. | $1744.28 | c. | $1801.41 | d. | $1833.74 |

|

|

|

11.

|

Based on the “Return to Investment” table below, if a farmer had

$400 to invest in the present farming business, how much should he invest in machinery for the most

net farm income?

|

|

|

12.

|

Charlie is trading his ford for a John Deere. What is the basis (for tax

purposes) of the John Deere tractor if Charlie traded in the ford tractor and gave $1,200 boot to a

dealer? Original cost of the Ford tractor traded- $1,600. Depreciation taken on the Ford tractor

traded -$5,000. Dealers’ price of the John Deere tractor $15,600

a. | $5,800 | b. | $11,000 | c. | $12,000 | d. | $15,000 |

|

|

|

13.

|

The price of a product moves from $100 to $90 and, as a result the quantity

demanded increases from 50 to 60 units. From this we can conclude that:

a. | the demand for the product is elastic | b. | the demand for the product is

inelastic | c. | the demand for the product is of unit elasticity | d. | the demand for the

product has declined |

|

|

|

14.

|

A corn farmer at harvest time may find his basses 37 cents under the May future.

In late April, he estimated that it would be 8 cents in May. His conclusion should be that he can

profitably store the grain for:

a. | $.37 cents | b. | $.08 cents | c. | $.29 cents | d. | $.45

cents |

|

|

|

15.

|

Return to management is net cash farm income:

a. | Minus debt payments | b. | Minus the value of unpaid labor, depreciation.

interest on equality capital and net inventory changes | c. | Minus the value of operators labor and interest

on debt payments | d. | Minus the interest on equity capital, depreciation and adjustments for inventory

changes |

|

|

|

16.

|

The Rogers farming has 2,000 bushels of corn (56 lbs corn per bushel) stored at

a rented farm. They can sell it at a local elevator for $2.60 per bushel. There is a hog

feeding facility available on the farm, and the Rogers are considering the corn to the hogs. They can

buy 50 lb feeder pigs for $0.70 per lb delivered to the farm. The Rogers will grind and mix their own

hog feed. The ration consists of 80% corn and 20% commercial supplement delivered for $210 per ton.

They would plan to market the hogs at 240 lbs. They expect a 3.8 to 1 feed conversion ratio.

How much feed supplement will they need to buy to mix with the 2,000 bushels of corn?

a. | 22,400 pounds or 11.2 tons | c. | 50,000 or 25

tons | b. | 28,000 or 14 tons | d. | 112,000 or 56 tons |

|

|

|

17.

|

The Rogers farming has 2,000 bushels of corn (56 lbs corn per bushel) stored at

a rented farm. They can sell it at a local elevator for $2.60 per bushel. There is a hog

feeding facility available on the farm, and the Rogers are considering the corn to the hogs. They can

buy 50 lb feeder pigs for $0.70 per lb delivered to the farm. The Rogers will grind and mix their own

hog feed. The ration consists of 80% corn and 20% commercial supplement delivered for $210 per ton.

They would plan to market the hogs at 240 lbs. They expect a 3.8 to 1 feed conversion ratio.

Given the limited corn supply, how many pounds of gain (at 3.8 to 1) can they get if

they feed an 80-20 ratio.

a. | 28,000 lbs | b. | 29,474 lbs | c. | 35,000 lbs | d. | 36,842

lbs |

|

|

|

18.

|

The Rogers farming has 2,000 bushels of corn (56 lbs corn per bushel) stored at

a rented farm. They can sell it at a local elevator for $2.60 per bushel. There is a hog

feeding facility available on the farm, and the Rogers are considering the corn to the hogs. They can

buy 50 lb feeder pigs for $0.70 per lb delivered to the farm. The Rogers will grind and mix their own

hog feed. The ration consists of 80% corn and 20% commercial supplement delivered for $210 per ton.

They would plan to market the hogs at 240 lbs. They expect a 3.8 to 1 feed conversion ratio.

What is the feed cost per ton of feed using the 80-20 ration?

a. | $92.85 | b. | $116.29 | c. | $163.15 | d. | $210.00 |

|

|

|

19.

|

The Rogers farming has 2,000 bushels of corn (56 lbs corn per bushel) stored at

a rented farm. They can sell it at a local elevator for $2.60 per bushel. There is a hog

feeding facility available on the farm, and the Rogers are considering the corn to the hogs. They can

buy 50 lb feeder pigs for $0.70 per lb delivered to the farm. The Rogers will grind and mix their own

hog feed. The ration consists of 80% corn and 20% commercial supplement delivered for $210 per ton.

They would plan to market the hogs at 240 lbs. They expect a 3.8 to 1 feed conversion ratio.

The Rogers buy 175 feeder pigs weighing 50lbs and plan to feed them to 260 market weight.

What is their total feed cost with the 3.8:1 feed conversation ratio:

a. | $2,136.82 | b. | $6,483.75 | c. | $8,119.95 | d. | $9,756.15 |

|

|

|

20.

|

The Rogers farming has 2,000 bushels of corn (56 lbs corn per bushel) stored at

a rented farm. They can sell it at a local elevator for $2.60 per bushel. There is a hog

feeding facility available on the farm, and the Rogers are considering the corn to the hogs. They can

buy 50 lb feeder pigs for $0.70 per lb delivered to the farm. The Rogers will grind and mix their own

hog feed. The ration consists of 80% corn and 20% commercial supplement delivered for $210 per ton.

They would plan to market the hogs at 240 lbs. They expect a 3.8 to 1 feed conversion ratio.

If costs other than feed or pigs were $25 per pig, what is the break even selling

price?

a. | $39.77 per cwt | b. | $40.03 per cwt | c. | $40.42 per cwt | d. | $40.92 per

cwt |

|

|

|

21.

|

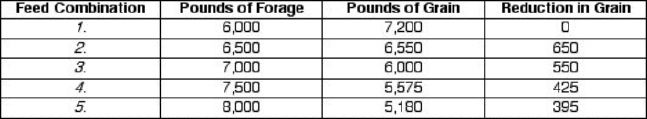

The table below shows different combination of forage and grain that will

produce 12,000 pounds of milk.  Which feed combination in the above table

is the lowest cost combination if the forage is $60 per ton (3 cents per pound) and grain is $4 per

hundred weight (4 cents per pound) a. | Feed combination 2 | c. | Feed combination 4 | b. | Feed combination 3 | d. | Feed combination

5 |

|

|

|

22.

|

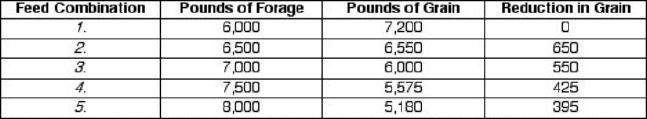

The table below shows different combination of forage and grain that will

produce 12,000 pounds of milk  Which combination would you use if all

prices in the previous question decreased by one-half? a. | Feed combination 2 | c. | Feed combination 4 | b. | Feed combination 3 | d. | Feed combination

5 |

|

|

|

23.

|

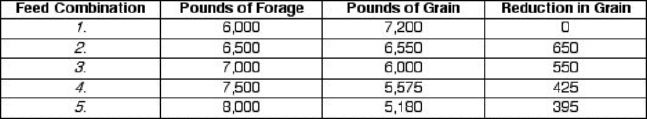

The table below shows different combination of forage and grain that will

produce 12,000 pounds of milk  Which feed combination in the table

would you use if the price of forage is $60 per ton and the price of grain decreased to $3.00 per

cwt. (.03 cents per lb.) a. | Feed combination 2 | c. | Feed combination 4 | b. | Feed combination 3 | d. | Feed combination

5 |

|

|

|

24.

|

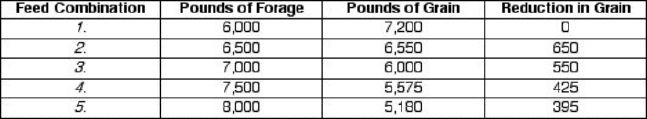

The table below shows different combination of forage and grain that will

produce 12,000 pounds of milk.  Assume the price of grain is once

again $4.00 per cwt. What price of forage per ton would make feed combination #1 best choice? a. | $ 74 per ton | c. | $ 104 per ton | b. | $ 96 per ton | d. | More than $104 per

ton |

|

|

|

25.

|

Mr. Rogers, a corn-hog farmer, had a profit and loss of $40,000 last year. The

farm had an investment of $250,000. The farmer owed $100,000 and paid $10,000 interest. He values his

labor and management at $15,000 (based on opportunity cost). The value of farm production was

$1000,000. The farmer believes that his opportunity cost for his equity in the farm business is

10%.

Were his financial returns to capital, labor and management satisfactory for this

type of farm?

a. | Return to capital was equal to his opportunity cost of capital | b. | Labor and management

returns were equal to his opportunity | c. | Return to capital was equal to the rate of

interest on debt | d. | All of the above are indications of satisfactory financial

returns |

|

|

|

26.

|

Mr. Rogers, a corn-hog farmer, had a profit and loss of $40,000 last year. The

farm had an investment of $250,000. The farmer owed $100,000 and paid $10,000 interest. He values his

labor and management at $15,000 (based on opportunity cost). The value of farm production was

$1000,000. The farmer believes that his opportunity cost for his equity in the farm business is

10%.

What was his total liabilities/ assets ratio for the farm?

|

|

|

27.

|

Cash operating

income

$90,000

Cash operating

expence

$60,000

Inventory

increase

$9,000

Capital items purchased (cash

boot)

$11,000

Value of unpaid family

labor

$

Interest on equity

capital

$13,000

Real estate and machinery

sold

NONE

Inventory

decrease

NONE

Farm produce used at

home

$1,000

The return to labor, management and equity capital for this farm was:

a. | $30,000 | b. | $29,000 | c. | $28,000 | d. | $15,000 |

|

|

|

28.

|

Cash operating

income

$90,000

Cash operating expence

$60,000

Inventory

increase

$9,000

Capital items purchased (cash

boot)

$11,000

Value of unpaid family

labor

$

Interest on equity

capital

$13,000

Real estate and machinery

sold

NONE

Inventory

decrease

NONE

Farm produce used at

home

$1,000

The farmer’s labor and management earnings were:

a. | $30,000 | b. | $29,000 | c. | $27,000 | d. | $15,000 |

|

|

|

29.

|

Purchasing a call option on corn means:

a. | The buyer is required to sell a corn future contract at a set

price | b. | The buyer may, but is not required, to sell a corn futures contract at a set

price | c. | The buyer may, but is not required, to buy a corn futures contract at a set

price | d. | The buyer is required to buy a corn futures contract at a set

price |

|

|

|

30.

|

A farmer with a long position in the futures market:

a. | Profits when prices decrease, loses when prices increase | b. | Profits when prices

remain unchanged | c. | Profits when prices increases, loses when prices decrease | d. | Profits when prices

remain unchanged |

|

|

|

31.

|

Farmer places too high a value on his feeder cattle in his December 31

inventory. The rest of his yearly records are accurate. In his record book summary, livestock returns

per $ 100 feed fed are:

a. | too high | b. | too low | c. | accurate | d. | no

effect |

|

|

|

32.

|

A farmer has an opportunity to buy a new piece of machinery for $4,000 (no

trade-in). He expects to depreciate the item out over three year period. He estimates that the

opportunity cost of his money (or interest rate) IS 8%. He will set the salvage value of the piece at

$700 at the end of the three year period.

The maximum straight line depreciation that the

farmer can claim for each of the three years is (without any first year investment cost):

a. | $1,333 | b. | $1,233 | c. | $1,100 | d. | $1,033 |

|

|

|

33.

|

A farmer purchased a used tractor. The tractor cost $3000. He paid $1200 cash

and financed the remainder for 6 months. His monthly payments for interest and principal was $316 per

month. What rate of interest did the farmer pay on his loan?

a. | Less than 5% per annum | b. | 5.3% per annum | c. | 10.7% per

annum | d. | Approximately 18% per annum |

|

|

|

34.

|

A cattle feeder is interested in forward pricing (hedging) his cattle on feed

which should be ready for market on August 1st. What action should the cattle feeder take in the

futures market after he buys cattle?

a. | Sell the August futures contract | c. | Buy the April futures

contract | b. | Buy the August futures contract | d. | Sell the April futures

contract |

|

|

|

35.

|

A farmer plans on buying 70 tons of soybean meal in May of next year. The meal

will be fed to the dairy herd throughout the year. It is now August and the farmer expects the price

of soybean meal to increase greatly next May.

What should the farmer do to provide protection

from the anticipated increasing price of soybean meal?

a. | Buy August soybean meal contracts | b. | Sell May soybean meal futures contracts today,

expecting to buy them back in August | c. | Sell August soybean meal futures contract

today, executing to buy them back in April | d. | Buy May soybean meal futures contracts today,

expecting to sell them on May |

|

|

|

36.

|

Mr. Mistake made an error in his record of livestock purchases. He wrote down a

figure that was $1,000 to low. All other records were accurate. These livestock were not sold until

the next year. In his year end summaries, his income, using the cash method is:

a. | too high | b. | too low | c. | accurate | d. | no effect |

|

|

|

37.

|

Agricultural prices are difficult to predict, yet they must be used in preparing

farm budgets. Which of the following statements regarding price estimates is correct?

a. | For decisions that have short-run implications, such as purchase of additional

livestock or the expansion of an enterprise, current prices adjusted with the best outlook

information are recommended. | b. | For decisions of a longer-run nature, such as

the purchase of land or the construction of a building, long-run price relationships probably will be

irrelevant | c. | Current prices are good estimates of long-run relationships | d. | None of these are

correct |

|